Best Time To Refi

Learn when to refinance your mortgage for maximum savings. Understand interest rate trends, calculate your break-even point, and discover tools to help you act at the perfect moment.

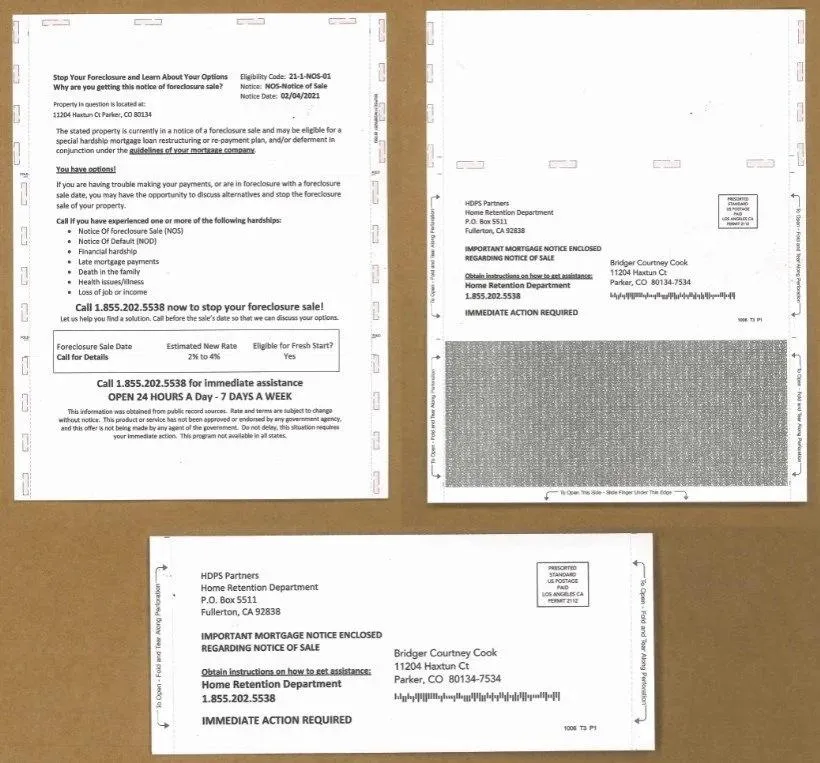

Beware of Fake Mortgage Rate Ads

Learn how to spot misleading mortgage rate ads and understand the hidden costs behind “low rates.” We break down discount points, origination fees, closing costs, and lender credits — so you can make smart, informed decisions and potentially save thousands when refinancing. If you want, I can also draft a shorter, punchy version for social sharing that drives clicks to your Interest Rate Watch Funnel.

3 common mortgage mistakes

Buying or refinancing a home is a huge financial decision, and even small mistakes can cost you thousands of dollars. Many homeowners fall victim to misleading ads, hidden lender fees, or unnecessary mortgage points — all of which can quietly inflate the cost of your loan. At A Plus Funding, we help borrowers navigate the mortgage process with clarity and confidence. In this blog, we cover the three most common mortgage mistakes: trusting spam mortgage mailers or online ads with hidden charges, paying excessive discount points or lender fees that don’t save money long-term, and relying solely on a real estate agent’s preferred lender without comparing quotes. Each of these pitfalls can add up to thousands in avoidable costs, but knowing what to watch for gives you the power to make smarter financial choices. We also share tips on how to shop for a mortgage wisely, compare loan estimates, and spot hidden fees so you can secure the best deal possible. Whether you’re buying your first home, refinancing to lower your rate, or simply exploring your options, this guide helps you avoid costly mistakes and take control of your mortgage. 📞 Ready to get a transparent, no-obligation mortgage quote? Contact A Plus Funding today and see exactly what you’re paying for — no hidden fees, no surprises, just peace of mind.