Beware of Fake Mortgage Rate Ads

Don't Fall for Fake Rate Ads: What Those Low Mortgage Offers Really Cost

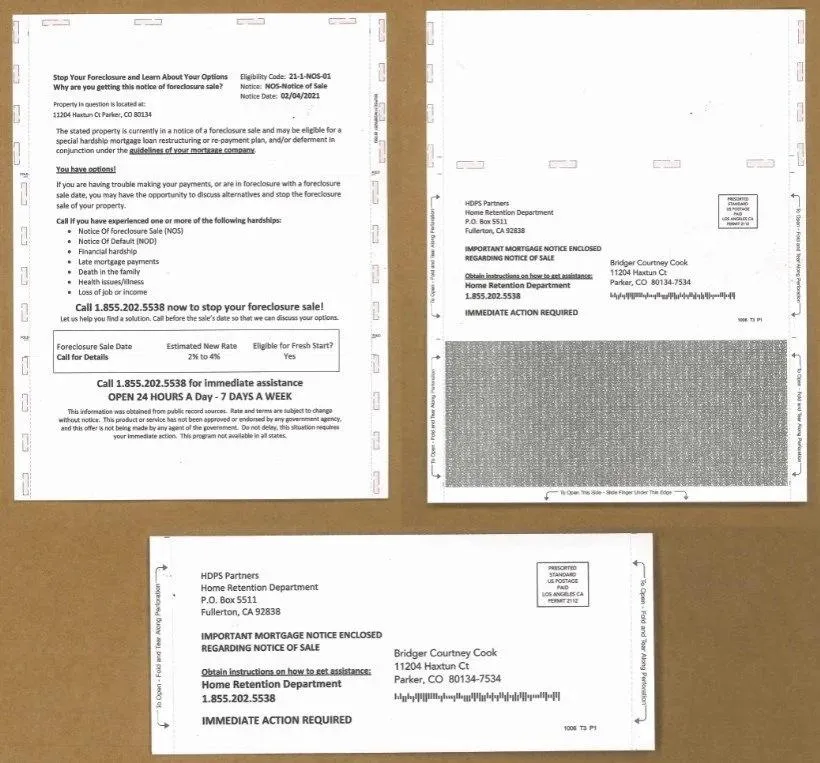

Scroll through your feed for five minutes and you'll see them: mortgage ads shouting "Rates in the 4's!" or "Refinance now and save thousands!"

It's tempting. A lower rate means lower payments, right? But here's the reality—most of these eye-catching offers come loaded with expensive fees buried in the fine print that can actually cost you more in the long run.

Let's break down what's really happening behind those "unbelievable" rate ads—and how to avoid getting burned.

⸻

1. The Hidden Cost Behind "Unbeatable" Rates

When a rate looks suspiciously lower than the competition, there's usually a reason: discount points and origination fees added to your closing costs.

Discount points are essentially prepaid interest. Each point costs 1% of your loan amount and typically lowers your rate by roughly 0.25%.

On a $500,000 loan, buying two points means shelling out $10,000 upfront just to shave a fraction off your rate.

That might pencil out if you're staying in the home for a decade, but most homeowners need 5–7 years just to recoup those costs—and many refinance or move before then.

⸻

2. Why Closing Costs Spiral Out of Control

Those "too good to be true" rates often come with bloated closing cost sections on your Loan Estimate. Common culprits include:

Discount points

Origination or processing fees

Underwriting and administrative charges

Escrow, title, and appraisal expenses

Once you tally everything, that "incredible rate" can easily cost you $10,000–$15,000 more than a straightforward market-rate offer with minimal fees.

⸻

3. A Better Strategy: Leverage Lender Credits Instead

At A Plus Funding, we flip the script. Rather than loading you up with points and hidden charges, we often structure loans using lender credits—money that goes directly toward covering your closing costs.

Here's the trade-off:

You accept a marginally higher rate (typically 0.125%–0.25% above the advertised "rock bottom" rate)

The lender provides a credit that pays for appraisal, title, origination, and other closing fees

Your out-of-pocket costs drop dramatically—sometimes to zero

This approach makes financial sense if you're planning to refinance within a few years, anticipate selling, or simply prefer not to drain thousands from your savings to chase an advertised rate that may not even benefit you long-term.

⸻

4. Red Flags: Spotting a Deceptive Offer

Before committing to any mortgage or refinance, protect yourself:

Request a complete Loan Estimate showing the rate, APR, and itemized fees

Ask directly: Are there discount points or origination charges built into this rate?

Verify credentials by checking the lender's NMLS ID at nmlsconsumeraccess.org

Skip ads that omit the APR or total cost—that's a warning sign

Transparency matters. A rate is meaningless without understanding the full financial picture behind it.

⸻

5. Get Market Updates Without the Sales Pitch

Stop chasing misleading ads and guessing about timing. Join our Interest Rate Watch List to receive real-time market analysis and alerts when refinancing actually makes sense for your situation—no spam, no pressure, just honest guidance.

👉Join the Interest Rate Watch List and get straight answers from the licensed mortgage professionals at A Plus Funding.